05 NOV 2025

Why it's better to start saving for your retirement in your 20s and 30s

We all know the parable of the race between the tortoise and the hare.

The hare believes he can win by having a leisurely sleep and leaving it to the last minute – confident he can use his superior speed to make a late sprint to the finish line.

The tortoise though has a different strategy… he starts early and slowly covers the distance at a comfortable pace, calmly reaching the finishing line without breaking a sweat.

The analogies with saving for your retirement are very striking. The tortoise will always beat the hare when it comes to retirement saving – and it’s largely thanks to the benefits of compound interest.

Time is your friend

In our 20s and 30s we have so many competing pressures on our finances. Whether it’s saving or paying for a home, the cost of starting a family or paying for a wedding, it seems that your money is being pulled in every direction.

The hare believes that retirement is so far away he can ignore saving now and make up for it in the future. However, the tortoise knows the importance of prioritising saving something for their retirement.

And starting early really is the key. You don’t have to save a huge amount each month either. It’s about establishing the commitment, learning to become a disciplined saver and then sitting back to let compound interest work its magic.

Compound interest is a simple concept. If you put £100 into your pension when you’re 25, and we assume it grows by 5% a year (which is not guaranteed of course), then by the time you are 65 that £100 will have grown to £704.

Case study

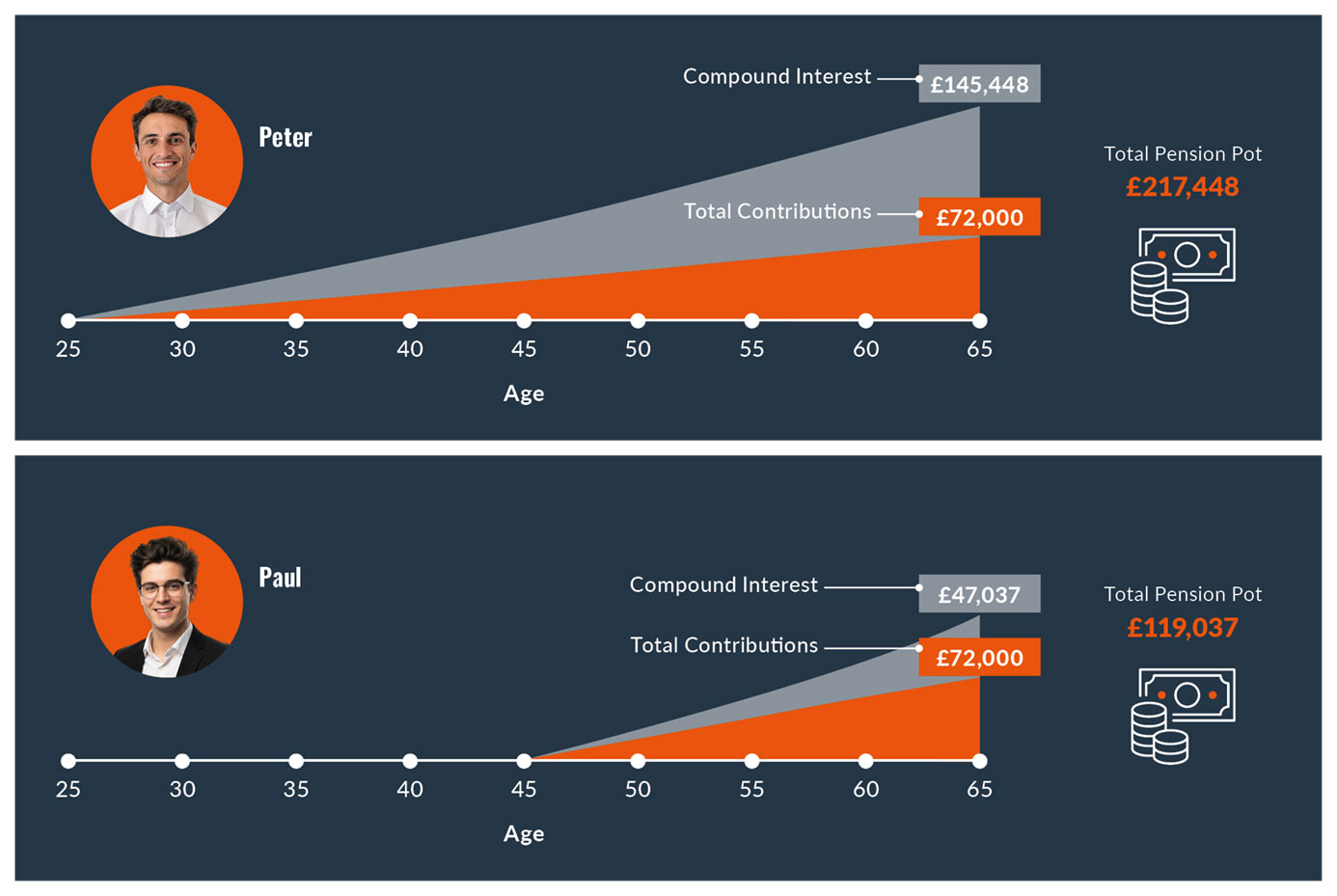

Peter and Paul are old school friends and they are now both 25 years old, working full-time and are each earning £28,000 a year. When they meet for a catch-up, they discuss whether they should begin putting something aside each month for their retirement.

Peter

Peter decides that he is going to start saving £150 a month into a pension plan. He continues adding £150 a month into his pension plan for the next 40 years. By the time he is 65 he will have invested a total of £72,000.

Paul

Paul decides his retirement is many years in the future and he has more pressing financial priorities. He vows to start saving for his retirement “in the future”.

20 years later Peter and Paul meet up again.

Peter has been saving £150 for 20 years and his pension pot currently is currently valued at nearly £60,000. This shocks Paul, who still hasn’t started saving yet, into action.

However, he believes he can catch Paul up if he now saves £300 a month. His reasoning is that by the time they both reach 65, both he and Peter will both have invested £72,000.

But Paul has underestimated the importance of compound interest, as the table below shows.

Peter

Peter saved £150 a month for 40 years = £72,000.

When he’s 65, assuming a 5% annual growth, his pension is now worth £217,440.

Paul

Paul saved £300 a month for 20 years = also £72,000.

When he’s 65, assuming a 5% annual growth, his pension is now worth only £119,037.

Although they have both invested the same amount of money, Peter’s pension is worth almost twice that of Paul’s. And it’s all down to compound interest. Over 40 years, Peter benefited from £145,448 of interest. Because his investment horizon was only 20 years, Paul received interest of only £47,037.

In fact, to match Peter’s pot of £217,440, Paul would have needed to invest almost £550 a month from age 45 to catch up.

Of course, the reality is it’s never too late to start saving for retirement, and Paul is in a much better position than if he’d not saved at all or started saving even later in life. However, the earlier you start, the easier it becomes to create a sizable pension pot.

Peter’s modest contribution £150 a month achieved a pot size of over £217,000 after 40 years.

Indeed, if Paul had decided to increase his pension contributions by an affordable 5% every year - a realistic target given expected pay rises and more financial stability as he gets older - his pension pot at age 65 would be an impressive £504,770.

Now of course it’s not guaranteed that a pension pot will grow at 5% a year, this is an example assumption only. However, the example demonstrates very clearly why it’s better to be a tortoise than a hare when it comes to saving for your retirement.