Introduction

Last year IFGL Pensions teamed up with International Adviser to explore client attitudes towards retirement planning. The goal was to find out how financially prepared advisers felt their clients were for retirement, and to explore the attitudes those clients had regarding saving for retirement.

The results were revealing and worrying.

Most clients are significantly under-prepared, and are likely to face a nasty surprise when they near retirement, unless they take action. There is a massive gap between the client expectation, and the reality of their (current) situation.

There is, however, a huge opportunity for Financial Advisers to take the lead and guide their clients towards positive outcomes. But those conversations need to be frank, and need to take place as early as possible.

Attitudes towards starting to save for retirement

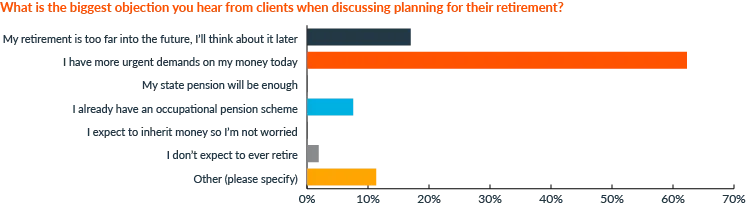

By far the biggest obstacle in persuading clients to start saving for their retirement is that they have more urgent demands on their finances, whether that be paying off student loans, saving for a home of their own, or starting a family.

Many clients have no idea how much they will need to save for retirement (see later) and to others it is a daunting prospect to start saving for an event so many years in the future.

Retirement can feel a long way in the future when compared to more immediate demands on their money. And this can lead to inertia and procrastination when it comes to starting to save.

This delay is a huge missed opportunity, and is storing up a bigger problem for the future, with less years to save for retirement, and less years to benefit from compound growth in their pension pot.

While we all sympathise with those financial pressures in the early years, this is the time we need to help clients understand the importance of starting to save early. Making even small pension contributions early on can have a massive effect on their future pension pot.

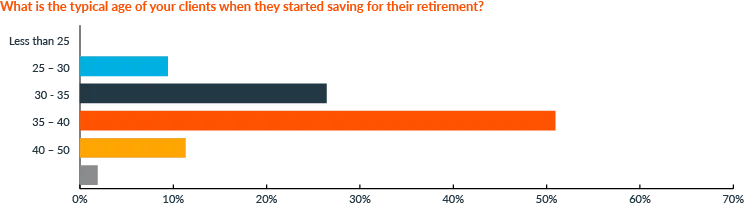

This financial pressure in early working life in turn leads to only a third of clients starting to save for their retirement before they reach their late 30s. This means that two-thirds of people are looking to save a sufficient amount for their retirement in 30 years or less.

When discussing pension contributions to clients in their 20s and 30s, it is often sensible to suggest starting with very small contributions, but to increase the contributions by 0.5% or 1% each year. These are small increases which most people will not notice (especially if timed to coincide with pay increases) but through compound interest/investment returns their pension pot will grow appreciably over the coming 30 or 40 years. It’s never too early to start saving for your pension.

Embedding a savings habit early is also a great way to avoid the cliff-edge financial shock of suddenly having to find large sums of money each month to save into a pension in their late 30s and 40s, when they may have been used to enjoying a lifestyle linked to their overall income. By starting small, and increasing pension savings gradually, this should feel much less painful to clients than figuring out where to cut back later.

We understand there is more that we can do to help you with these conversations too, so look out for some helpful guides and case studies that you can use in these conversations with clients.

What retirement do people expect?

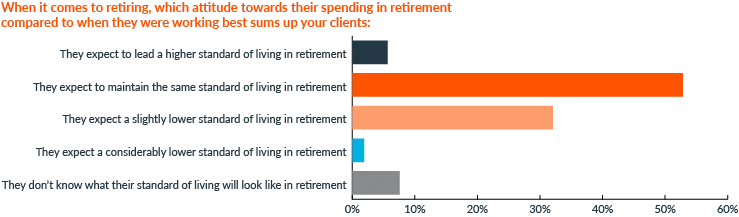

It is perhaps little surprise that over half of people expect to maintain the same standard of living in retirement, or an even higher standard, than they enjoy while working. Only around a third accept their standard of living will decrease.

While this is all very well, how realistic is it? The answer of course depends on how well they have prepared for their retirement during their working lives.

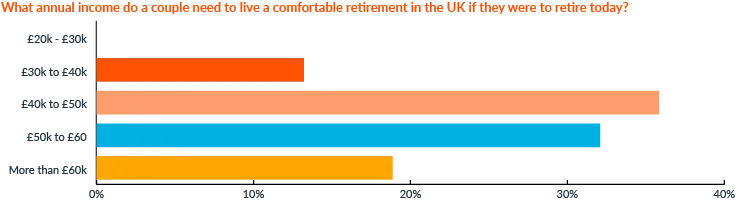

But what will they need to save to fund a “comfortable retirement”?

Advisers estimate that a couple retiring in the UK today will require an annual income of £40/60,000 to live comfortably. Of course, that income is likely to increase in the years ahead as inflation erodes the value of money. This seems very realistic.

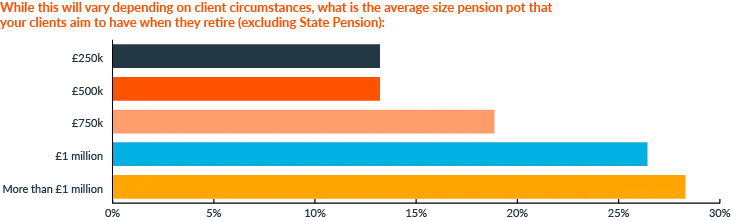

So what size pension pot will clients need to fund that “comfortable retirement”? There are a few variables to consider here, such as what age they intend to retire at, their health and what their spending plans are.

It’s useful to use the UK State Pension as a benchmark. Currently a full UK State Pension provides an annual income for each person of approximately £11,500 (2024-25 tax year) from age 66 currently (rising to 68 for those in their mid to late 40’s now). That equates to a pension pot lump sum equivalent of over £230,000 (based upon market annuity rates for a 65 year old purchasing a Single Life annuity, with a 5 year guarantee period, and increasing in line with RPI each year: Source: Annuity Rates: View Best Annuity Rates from the UK Market).

A pension pot of £500,000 is likely to provide an annuity of approximately £32,300 per year if you retire at the current state pension age of 66. (Alternatively, depending on the pension you have, you may be able to take 25% of your pension pot - £125,000 in this example - tax-free. This then reduces your annual annuity to around £24,250.) Source: https://www.direct.aviva.co.uk/myfuture/PensionAnnuityCalculator/Lite

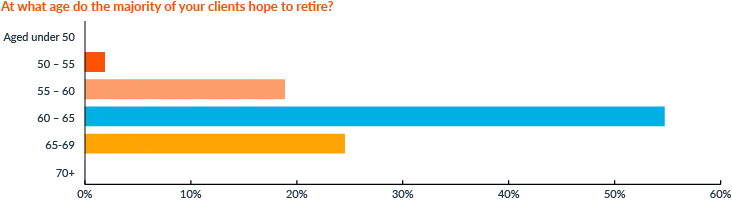

However, the graph above shows that around three-quarters of clients aim to retire before they reach the state pension age of 66 or 67.

The annual income from your annuity reduces significantly if you choose to retire before the state pension age. And of course there is no state pension until you reach 66 (or 67 if you were born after April 1960).

So if you plan to retire before 66 (or 67) you are likely to need a far bigger pension pot. How else will you fund those early retirement years?

Savers who spend all or part of their working life outside the UK will also need to consider whether reduced UK state pension entitlement might mean they need to save additional sums themselves to secure the standard of living they desire in retirement.

The cost of retirement

While financial advisers are very realistic about the size of a pension pot required to fund this comfortable retirement, the message is clearly not getting through to clients.

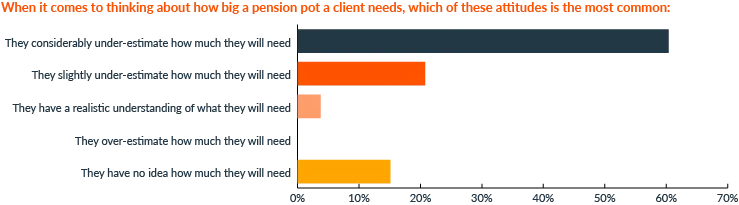

Perhaps the most shocking finding in this survey was that over 80% of people under-estimate the size their pension pot needs to be to fund the retirement they want – and most of them significantly under-estimate. Another 15% had no idea of what they would need. Only 5% had a realistic view of what they need to save for their retirement.

If clients don’t know they have a problem, they don’t know they need to solve it before it’s too late. This is where we can all help by providing the necessary education so that clients can plan and save for their retirement appropriately.

Where do clients plan to retire?

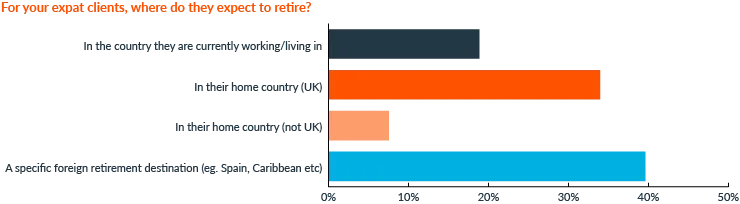

Only 4 in 10 of ex-pat clients intend to live their retirement back in their home country. Around 40% intend to move to a new country for their retirement, with Portugal and Spain in particular mentioned as the most popular retirement destinations.

This provides further opportunities for advisers to help their clients plan for retiring abroad, and ensure they are well prepared, both financially and practically, for the re-location once they retire.

While most UK based clients do intend to stay in the UK upon retirement, there is still a significant number who plan to retire overseas, and once again this provides opportunities for advisers to add value in helping them prepare for life in a new country.

How can financial advisers help?

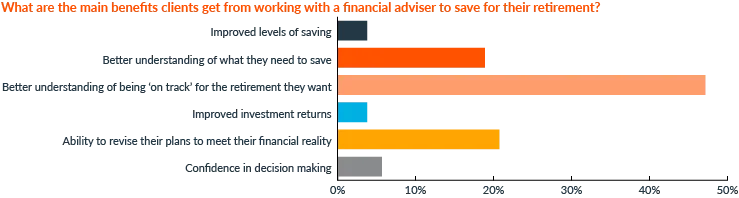

Keeping clients on track with their savings journey was the key value add that most advisers believe they offer. Providing unbiased and expert guidance will create strong and trusted relationships between a client and their adviser.

This is particularly important at transitional stages in a clients’ life, such as marriage, starting a family and preparing for retirement, where plans and priorities change. Equally important is helping clients navigate turbulent financial markets or changing regulations and make the right investment decisions.

Advisers can also encourage younger clients to start, and maintain, good financial habits and have a structured plan that is regularly reviewed and tweaked as appropriate.

It is, however, not always easy to communicate these benefits. Watch out for more materials from us that help you demonstrate the value of good, independent financial advice.

Key takeaways

- There is an enormous disconnect between the type of retirement clients expect to lead compared to the type of retirement they are currently on course to afford. 80% of clients underestimate how big a pension pot they will need – and three-quarters of these “significantly” under-estimate. Many clients have a huge shock in store unless they take action

- Financial advisers can play the key role in explaining how much clients need to fund the retirement they want

- Clients believe the most important service advisers provide is helping them keep their financial plans on track. Are advisers doing enough monitoring of their clients’ retirement provision?

- Clients are not starting to save for their retirement early enough. The benefits of compound interest and investment growth need to be explained better to make retirement funding a higher priority to clients in their 20’s and 30’s

- Most ex-pat clients do not intend to return to their “home” country to retire. Understanding where clients intend to live after they finish working is crucial in planning and optimising their financial strategy for retirement